People seem to be doing the exact opposite of this lately. Rather than making money go further, the majority of us seem to be draining it out of our bank accounts quicker than we can blink. But, is this always our fault? No, it’s not.

Sometimes, situations occur in life that leads us down a bad path with money. But that bad path always has an ending, yours can be just around the corner if you follow this article.

We all want our money to go further, and we all want to have more money. If you’re not sure what you can do at the minute to change your situation, have a read of the tips below to help make your money go further.

Money Planning

Money planning is something a lot of you might never master. Instead, you’ll have your wages come into your bank account, and before you know it, it’ll fly right out again because you’re using your card for absolutely anything.

If you don’t money plan, your money is never going to go further. You know the obvious costs that you’re going to have to deal with. You’ve got your bills, fuel, and a weekly food shop.

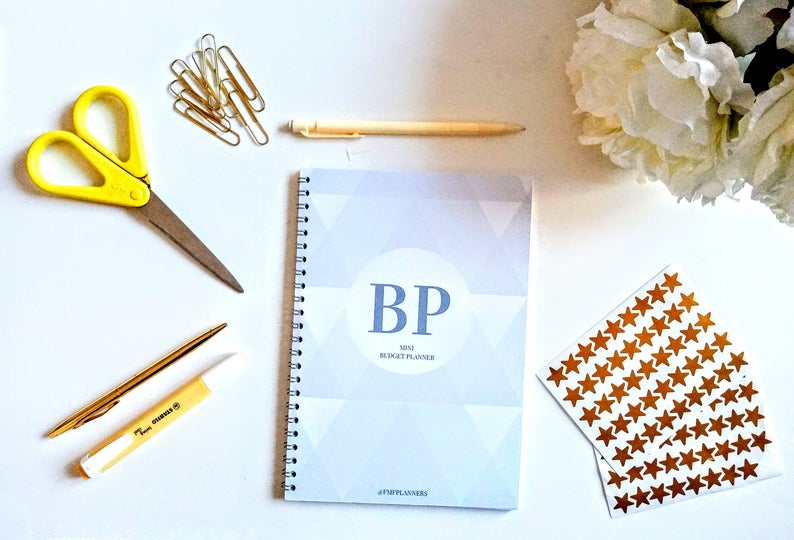

Account for all of these expenses by keeping a budget book like below. Write down all money coming in and deduct all outgoings. Do this at the end of every month when you get paid so that you know how much money you have.

I love this *A5 softback undated budget planner notebook. The budget planner is undated and therefore means you can manage your finances very easy with its flexible design.

With the money that’s left, plan for things that you might want to do in the month, or treat yourself to, put some into a savings account. If you give yourself a weekly budget of spending, you can then plan around that.

Check your bank regularly against your notes so that the balance is correct.

Reducing Outgoings

Reducing your outgoings is so essential if you want to save some money, and then make it go further. This ties in with your money planning. If you’re making a list of all of your outgoings at the start of every month, and your outgoings are more, then it’s time to find a solution.

Making It Go Further

If your main outgoings are trips out with friends, then think about whether these outings are necessary.

If you want to make it go further, you need to look for ways to reduce the money you’re spending. Take your food shopping as an example. You can make your money go further when grocery shopping.

There are plenty of store-branded products that you could swap to rather than buying the big brand products. You’ll find these products are just as good, but you’ll be spending a fraction of the money.

If you have your shopping delivered every week take advantage of the store’s *delivery saver service. This saves a fair amount of money each year.

Do you have a takeaway every week? Takeaways add up to a few hundred pounds a year so if you need to cut back start with these. Experiment making your own homemade meals.

There’s so much you can do to reduce your outgoings and make your money go further. I hope this helps with your money planning!